The Peninsula

Korea-China Trade Relations a Decade After China’s WTO Accession

By Troy Stangarone

The anniversary of China’s formal entry in to the WTO ten years ago this week comes as a mixed blessing for many of its trading partners. China’s entry into the WTO brought the world’s most populous nation into the rules based trading system that is the WTO and created new economic opportunities for all involved. The move paid off handsomely for China as it became the world’s second largest economy and largest trading nation, reshaping global commerce at the same time. For China’s trading partners the perspective is often different. Concerns continue to exist over China flooding markets with cheap goods and undervaluing its currency to the detriment of its trading partners, among other issues. One exception to this has been Korea, which despite the challenges others often see in exporting to the Chinese market has seen its own trade surplus with China grow significantly over the last decade.

That China has a trade surplus is not new. When China joined the WTO, its trade surplus was already $22 billion, but its surplus with the rest of the world has grown significantly in the intervening years. In 2010, China’s trade surplus with the rest of the world stood at $181 billion. However, the high water mark for China’s trade surplus came in at $298 billion in 2008 before the financial crisis took hold.

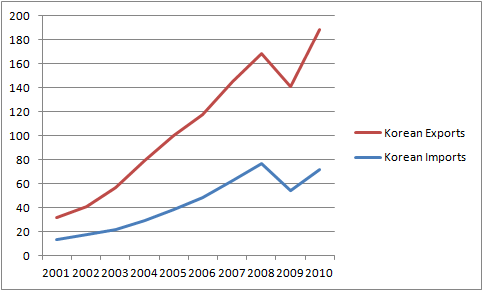

While countries such as the United States have seen their trade deficits with China widen over the last decade, Korea has seen its trade surplus with China grow from $2.9 billion in 2001 to $39.3 billion last year. Korea’s exports to China have grown from $10.4 billion in 2001 to $111.3 billion in 2010, or about $19.4 billion more than the United States. Since Korea and China did not have formal relations until 1992, this growth has really only come together in the last two decades.

Korea’s Exports and Imports with China

Source: Korea International Trade Association, Billions U.S. Dollars

Surprisingly, there has been little change in the composition of Korea’s exports to China. If one were to scan Korea’s top five exports to China in 2001, they would see many that are there today such as electronics, machinery, plastics, and organic chemicals. The only change has been a significant growth in liquid crystal and optical devices, but this also reflects a shift in the last decade in electronics, so does not come as much of a surprise. The composition of China’s trade with Korea remains fairly stable as well, with the exception of items of apparel being replaced with imports of Chinese steel and iron products.

While the composition of Korea’s trade with China may not have changed much in the last decade, the direction of Korea’s trade has changed over the last decade. In 2001, Korea’s trade with China was slightly less than with the European Union, which trailed both the United States and Japan in terms of trade with Korea. Today, the numbers aren’t even close. While Korea’s trade with the United States, Japan, and the European Union has continued to increase, trade with China has grown more than six fold to $188.7 in total trade. Put another way, Korea’s total trade with China is nearly the same as its combined trade with the United States and Japan. It appears as though a permanent shift in Korea’s trade has taken place in a relatively short period of time. And though the KORUS FTA should help boost trade between the United States and Korea, it seems unlikely that the United States will regain its lead anytime soon.

Korea’s Top Four Trade Partners

Source: Korea International Trade Association, Thousands U.S. Dollars

Over the last decade, Korea has successfully taken advantage of China’s continued integration into the global economy. While other nations have also benefited from China’s continued integration into global markets, perhaps few have to the degree of Korea. Korea initially utilized the Chinese market as an export platform to the United States and Europe, but overtime has begun to take advantage of opportunities in China’s own domestic market as well, with Korea’s share of trade with China for its domestic market hitting 50 percent in 2005. Over the long-term, the question for Korea will be whether it can continue to expand in China’s domestic market, while still using China as an export platform, or will China’s recent trends towards a more state driven, protectionist model of trade over time begin to undermine Korea’s success within China and begin to reverse the trade surplus Korea currently holds?

Troy Stangarone is the Senior Director for Congressional Affairs and Trade at the Korea Economic Institute. The views expressed here are his own.

Photo by SF Brit