The Peninsula

South Korea’s Strategic Investment Deals in the Middle East

Published October 15, 2012

Category: Korea Abroad, South Korea

By Seongjin James Ahn

Last week, state-owned Korea Gas Co. (KOGAS) beat out eight other bidders to secure a new $127 million pipeline deal in Iraq. The contract, to be signed later this month, heralds yet another lucrative investment project for South Korea which, in recent years, has been very assertive in winning investment contracts in the Middle East, particularly in Iraq and the U.A.E. In a time when U.S. and U.K. companies have been rather sleepy on Middle East investments, Korean enterprises have not only been active, but strategic as well.

In the grand scheme of things, Korean foreign direct investments (FDI) flowing annually to the Middle East is, frankly, not particularly substantial. Between 2007 to the present only about 1.6 percent of total Korean FDI outflows has been directed towards the Middle East. But in spite of the overall proportion of FDI from Korea to the Middle East, Korean companies have been strategically targeting investment opportunities in order to gain position in markets and take advantage of growth.

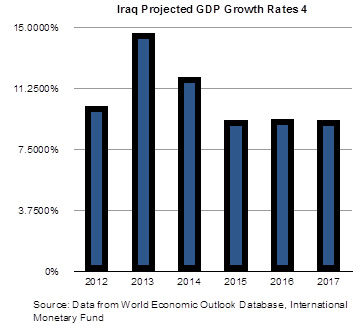

For example, after being politically, economically, and socially stifled by years of sanctions and war, Iraq is now in serious need of basic infrastructure development and its potential for growth has made the country ripe for investments. According to the Central Bank of Iraq, real GDP growth forecast for 2012 is 11.1 percent, and the IMF estimates that the economy will continue to grow above 9 percent annually into 2017.

Korean companies have taken advantage of this fact and have steadily increased their share of investments in Iraq over the last four years since 2008. Their investments in Iraqi infrastructure development, such as the KOGAS pipeline deal, have gained them valuable access into the nation’s future growth as well as favorable positions to secure more contracts in a country in which it is particularly difficult to do so.

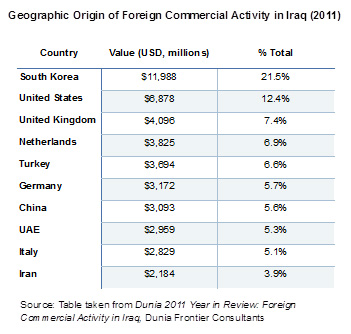

According to a report produced by Dunia Frontier Consultants, a frontier investment consulting firm based in the Dubai, 2011 was a particularly impressive year for Korean FDI in Iraq. First, the Korean firm Hanhwa secured the largest investment contract valued at $7.25 billion. Second, three out of the top 10 foreign deals in Iraq were made with Korean firms, a combined value of about $9.7 billion. Third, out of all foreign commercial activity occurring in Iraq, Korea had the single largest footprint with $11.9 billion, or 21.5 percent of all foreign commercial activity.

The U.A.E. is another country in which Korea has gained strategic investment positions. Earlier this year, in a move to diversify oil imports and decrease national dependency on Iran, state-owned Korea National Oil Corp. and GS Energy landed an investment deal in the U.A.E. giving them access to an estimated 570 million barrels in three oil production blocks.

In 2009, Korean firms also secured a coveted $20 billion deal to construct the first nuclear energy plant in the U.A.E. As reported by the Wall Street Journal, this investment is strategic in the sense that demand for nuclear technology is expected to increase substantially in the coming years as many reactors around the world will soon retire, and countries in the Middle East like the U.A.E. are looking to diversify energy sources away from natural resources. Again, as was shared by Chang Soon-heung, a nuclear and quantum engineering professor at Korea Advanced Institute of Science and Technology, when the deal occurred it was a positive start for Koreans to secure similar investments in the Middle East in the future.

Unfortunately, as it is with any type of investment, Korean investments in the Middle East do have some associated risks. In Iraq, for example, security costs (i.e. operating costs) run high given the obvious dangers involved with doing business in the country, which ultimately takes away from the bottom line. In 2011, countries across Northern Africa and Syria showed how precarious political circumstances can quickly destabilize a country and put the entire economy, along with investments, at risk. One type of risk that Korea does not seem to be affected by much, however, is reputational. For a country like the United States which led the war in Iraq, there is naturally a significant level of reluctance to invest in Iraq for reputational reasons; but this is not the case for Korea.

For better or worse, the U.S. has impassively (or regretfully, to some) foregone investments while its strategic partner, South Korea, has strategically gained. Whether or not Korean FDI flows to the Middle East will ultimately pay off remains in question, and over the next several years it will be interesting to see what type of investment deals Korea will approach next.

Seongjin James Ahn is a Visiting Fellow with the Korea Economic Institute. The views expressed here are his own.

Photo by Visit Abu Dhabi