The Peninsula

KORUS and EUKOR On Automotive: Progress, But Not There Yet

Published March 12, 2015

Category: South Korea

This is the third in a three part series on the U.S.-Korea Free Trade Agreement. The first part can be found here and the second part here.

By Daniel P. Malone

March 15, 2015 marks the third anniversary of the Korea – U.S. Free Trade Agreement (KORUS). July 1, 2015 will be the fourth anniversary of the Korea – European Union Free Trade Agreement (EUKOR). Some anniversaries are celebrated. Others merely provide the opportunity to assess – e.g. what has gone well, what remains unfinished. With only three – or even four – years behind them, these anniversaries fall into the latter category. But now seems a good time to take a snap shot of where things stand.

KORUS and EUKOR are comprehensive bilateral trade agreements. Both required considerable time and effort to negotiate. The trade negotiators of the participating nations were not writing on a blank slate. During 1998 – 2000, South Korea suffered through and recovered from an economic collapse. During 2008 – 2009, the United States experienced a similar meltdown and recovered. More recently, the European Union has struggled to shake off economic malaise. The cornerstone of these agreements is the belief that facilitating international trade would better position these nations going forward.

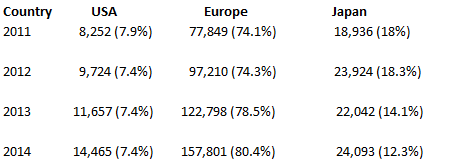

In the automotive industry, prior to these agreements, South Korean exports of vehicles were substantial. In 2011, South Korea exported just under 600,000 passenger vehicles to the U.S. and more than 400,000 vehicles to the E.U., whereas the U.S. and E.U. exported only 8252 and 77,849 vehicles, respectively, to South Korea, a market with annual sales just over 1.5 million. While both agreements promote trade, no trade agreement resolves that magnitude of imbalance in only a few years! Not surprisingly, these have not. To expect as much is fanciful. The more accurate, realistic measure is to examine whether the agreements have improved trade and eliminated troublesome impediments. On this third anniversary of KORUS – and soon-to-arrive fourth anniversary of EUKOR – the impact of these agreements on the automotive industry remains modestly encouraging.

Trade impediments are often characterized as tariffs or non-tariff barriers (NTBs).

In the hyper-competitive automotive industry, price matters. Tariffs affect the price of imported vehicles and components. Both agreements aggressively and successfully addressed tariff reduction or elimination. For example, the E.U.-Korea agreement immediately eliminated 82 percent of Korea’s tariffs and 94 percent of the E.U.’s tariffs; and by July 1, 2016, all tariff duties on vehicles will be eliminated. The KORUS FTA, on the other hand, eliminated some tariffs immediately and will eliminate virtually all automotive tariffs by 2017. So, progress on tariff reduction and elimination has been both material and encouraging.

NTBs, however, are another matter. For example, differences in regulations and standards present far thornier impediments. Idiosyncratic or unwarranted differences in regulatory requirements can be used to delay imports at the border over trivial technicalities. They can also unfairly limit access to domestic markets and effectively undermine the spirit, if not the letter, of trade agreements. One such critical area concerns safety standards. The impact of regulatory performance standards on global competitiveness combined with the complexity of the global automotive industry creates an interdependency between national regulations and international trade. This interrelationship mandates careful attention to how national safety and environmental requirements are developed and enforced. EUKOR and KORUS have taken differing approaches to addressing such crucial issues.

EUKOR relies predominantly on harmonized regulations facilitated by WP.29, the UN World Forum for the Harmonization of Vehicle Regulations. WP.29 has evolved into the world’s most important venue for the development of automotive regulatory requirements. Its harmonized UN regulations (f/k/a ECE regulations) were recognized as the equivalent to Korean safety standards. EUKOR further provides that, during a five year “phase in” period, South Korea will align its regulations with UN regulations. For regulations that fall outside of WP.29’s scope, South Korea has committed to ensuring that those regulations would not be enforced in a manner that limits access to its domestic market. While encouraging, European automotive manufacturers have expressed concern that South Korean NTBs are frustrating the underlying purpose of EUKOR to facilitate trade.

KORUS, on the other hand, addresses the development and enforcement of safety standards by allowing export sales to South Korea of up to 25,000 vehicles per manufacturer if the vehicles meet or exceed applicable U.S. safety standards. KORUS further requires that South Korea provide “early notice” for any proposed new regulations. To date, several such proposals by South Korean agencies have been contested by importers including, but not limited to, proposals regarding: self-certification of auto parts and equivalence; end of vehicle life responsibilities; unlimited scope of warranty/recall responsibilities; parts rules (e.g. certification, registration, and marking); notice regarding foreign recalls; VIN stamping; fuel economy tailpipe emissions audits; and proposed elimination of Table 4, which recognizes certain E.U. and U.S. safety standards as equivalent to Korean standards. In July 2014, at a U.S. Senate hearing on KORUS, a U.S. manufacturer’s representative testified that, “Although the U.S. government has engaged actively to address Korean NTBs in Korea, these NTBs have created a climate of regulatory uncertainty that has thwarted U.S. automakers’ plans.”[1] In a similar vein, a representative of a U.S. business association asked, “Why are Korean safety tests to evaluate automotive components not used anywhere else in the world?”[2] Of note, however, is that several other Korean proposals – e.g. Bonus Malus program (e.g. tax on larger, “more polluting” cars), CO2/Emissions targets – are opposed by foreign and domestic automakers.

For both the U.S. and the E.U., progress on NTBs has been less robust than on tariff reduction. Clearly, issues remain. As a result, proponents and opponents view these agreements through different lenses. For example, some question whether these agreements have resulted in job losses. Others challenge whether they have leveled previously existing imbalances on the field of competition. Still others wonder whether the agreements have been good for all of the respective nations and their manufacturers. In that regard, it is imperative to keep certain realities in focus. First, free trade agreements are not panaceas for challenges that the industry has always wrestled with. For example, free trade agreements do not cure lack of consumer demand, overcapacity, supply chain logistics, or lack of overall market strength, among many other issues facing the industry. In addition, free trade agreements do not “raise all boats”. Clearly, differentiating technologies, raised efficiencies, and overall marketing strategies largely separate winners from the rest. Not surprisingly, debate over the merit of these agreements continues and likely will for some time.

The realistic expectation for these agreements was that foreign manufacturers would see large percentage increases of the traditionally small numbers of foreign-made vehicles sold in South Korea, the world’s twelfth largest market. That is essentially what has happened. Vehicle imports made up 3 percent of automobiles sold in South Korea a decade ago. They now comprise 14 percent. German cars accounted for 71 percent of those sales.[3]

See, KAIDA (2015).

Initially, it appeared that Japan, while not a signatory to either agreement, might paradoxically reap the greatest benefits given Japanese manufacturers’ considerable manufacturing presence in the U.S. and E.U. But that has not materialized for a variety of reasons (e.g. recalls, geo-political considerations).

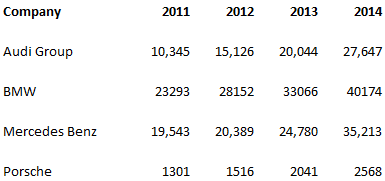

U.S. manufacturers, while experiencing steady sales, have yet to make such robust inroads. These figures raise the question: why not? In addition to the aforementioned regulatory uncertainty, three reasons come to mind. First, Korean consumers, especially adult males, currently consider BMW, Mercedes, and Porsche to be best in class. Second, European automakers like Volkswagen have been quicker to bring smaller, fuel efficient cars to the Korean market. Finally, German automobile manufacturers have built a long-term preferential relationship with Korean consumers. Given the commitment that U.S. automakers are making to the South Korean market, the above market shares and total sales will likely change.

Overall, in roughly three years, these free trade agreements have contributed to increased acceptance among South Korean consumers of foreign vehicles, especially in the luxury vehicle segments. According to the Korean press, Korea’s market for luxury vehicles is ranked among the world’s top five markets. One industry representative observed that Korean “consumers are turning their eyes to foreign makes.”[4] That is huge! At the moment, automakers from the E.U. – primarily Germany – have a comfortable lead in sales. In luxury brand imports to South Korea, Germans automakers have far outpaced any other nation’s.

See, KAIDA (2015).

With regard to South Korean manufacturers, their vehicles have continued to sell well in both the E.U. and U.S. markets. They have also wisely localized production in both markets. As they continue to do so, Korean automotive manufacturers’ “dependence” upon these trade agreements will likely diminish. Parenthetically, it is difficult to understand claims by KORUS opponents that the agreement has adversely affected, let alone “devastated”, the U.S. automotive economy as the vast majority of Korean automobiles currently sold in the U.S. are made in the U.S. (i.e. not linked to KORUS at all). Korean automakers and component suppliers are major employers in both markets.

What lies ahead? The global automotive industry and nations’ efforts to regulate it continue to evolve. Many other trade agreements in that region are well along in either the negotiation process or ratification. These include: the Trans-Pacific Partnership (TPP), which does not include South Korea and began negotiations before KORUS and EUKOR took effect; the Korea – China Free Trade Agreement, which has been agreed to but not yet ratified; the Canada – Korea Free Trade Agreement, which is now in effect; and the proposed Korea – Japan – China Free Trade Agreement, which is currently mired in negotiations. Each may impact EUKOR and KORUS. When these trade efforts are viewed collectively, it is clear that indisputable progress in market access and regulatory fairness will be crucial. Moreover, notwithstanding what the U.S. does or does not do, others are taking action. At the end of the day, though, the products themselves – and the efficient delivery and servicing of them – that automotive manufacturers offer consumers will likely differentiate winners from the rest of the industry.

Are we “there” yet? In a word, no. Substantial work remains, especially in regard to NTBs. South Korea’s automotive manufacturers will continue to do well in the E.U. and U.S. markets. Likewise, measurable progress has been made by European and, to a lesser extent, U.S. automotive manufactures in penetrating the South Korean market. Processes have been established to address and mitigate future NTB disputes by providing, among other things, “early notice” of proposed regulatory rulemaking. Significantly, both KORUS and EUKOR contain transparency provisions throughout. Transparency promotes constructive interaction. As Korean regulators propose new safety and environmental standards, all will benefit from proceeding in as transparent and inclusive a manner possible. This is why the automotive industry should be modestly encouraged by the brief history of these two bilateral trade agreements.

Daniel P. Malone, an attorney with the Detroit-based firm Butzel Long, is the firm’s Director of Korean Client Relations. He has travelled to South Korea extensively and has considerable experience representing the interests of both Korean and domestic automotive suppliers. Among other things, he also serves as a consultant to the Michigan Economic Development Corporation (MEDC) on South Korea’s automotive industry.

Photo from wwian’s photostream on flickr Creative Commons.

[1] See, Testimony of Stephen E. Biegun, U.S. Senate Committee On Finance, Trade Subcommittee, July 29, 2014.

[2] See, Kirk, No Chorus for KORUS, Forbes.com (July 25, 2014).

[3] Hyunjoo Jin, Foreign Imports Erode Sales of South Korean Automakers, New York Times, Nov. 17, 2014.

[4] Hyunjoo Jin, South Korea turns up the heat as foreign automakers make inroads, Reuters.com, June 13, 2013.