The Peninsula

China’s North Korea Trade Surges in August: Are sanctions busted?

By William Brown

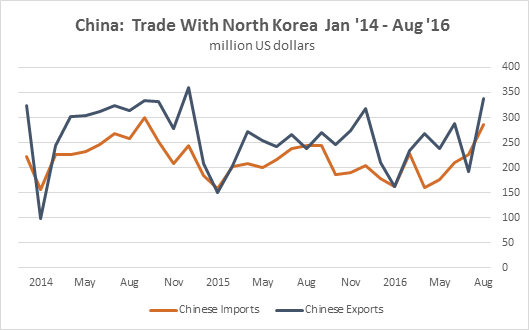

Any hopes that last spring’s “toughest ever” UN Security Council sanctions would cripple North Korea’s economy are likely to be dashed by recently released Chinese customs data. An August surge in Chinese exports to North Korea, up 41 percent from a low point a year ago, and a 16 percent boost in Chinese imports, brought bilateral trade back to near record 2013 levels. Even worse, the strong China-North Korea performance stands in contrast to recently dismal global Chinese trade patterns. Exports to South Korea through August, for example, fell 6 percent from year-to-date levels in 2015, and imports from South Korea fell nearly 10 percent, crimping South Korean GDP growth. Worldwide, Chinese exports year-to-date also were down 6 percent and imports were down 9 percent, although August itself showed some bottoming out. The U.S., Japan, Hong Kong and South Korea are China’s top trade partners and North Korea is ranked only about 58, even with the shifts, but for Pyongyang this trade is vital as its trade with the rest of the world has dwindled to almost nothing.

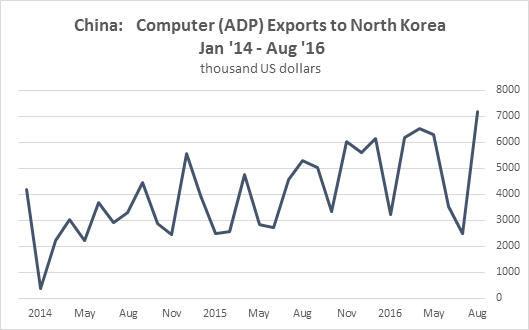

- Chinese exports to North Korea, excluding non-reported crude oil shipments, reached $337 million in August, the highest total since December, 2014. Computer shipments, at $7.2 million for the month, and auto and motorcycle sales, are showing the largest growth.

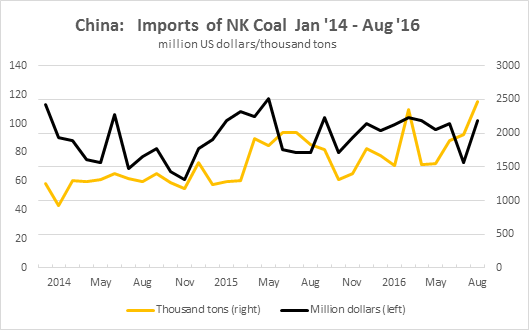

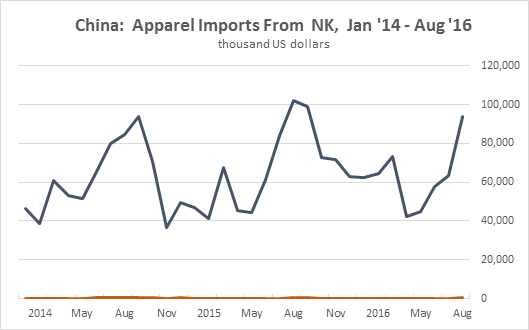

- Chinese imports registered $286 million, up 17 percent from August, 2015. Anthracite coal, at $113 million, provided the biggest boost, despite specific UN prohibitions on buying North Korean coal, and Chinese apparel purchases rebounded to 2014 levels.

- There is no indication that China, or anyone else, is providing credit to North Korea, except for the non-reported crude oil that is provided on a long-term, no interest, line of credit that is never repaid, so North Korea’s trade gap of about $50 million a month is probably being covered by remittances, by other service earnings of North Koreans abroad, and small amounts of aid including from UN agencies operating inside North Korea. A detailed balance of payments accounting for North Korea is not available, however.

- Pyongyang’s trade with the rest of the world remains miniscule and seems to be falling near to zero in the face of the UN sanctions.

China signed on to the UN sanctions last March, after North Korea’s fourth nuclear test, submitting its formal support document on 20 June well in time to affect trade by August, and is talking with the U.S. and other members of the Security Council about strengthening them following last month’s fifth test.

But the absence of any obvious crisis in China-North Korea trade might easily be seen as China disregarding economic pressure tactics on North Korea or as retaliation for this summer’s Seoul-Washington agreement to install THAAD missile defense in South Korea. Either or both are possible, but it’s important to recognize that Chinese interpretations of the UN sanctions rules are very different from U.S. official views, which may be rather exaggerated. China insists sanctions should not hurt the livelihood of North Koreans, and thus the economy at large, and must be narrowly targeted at the military and nuclear establishments. In contrast, a senior U.S. White House official just last week, said the sale “even of a pencil” to North Korea is prohibited since it could be used for nuclear weapons design. The U.S., since the Korean War, has maintained close to an embargo on trade with North Korea; technically trade can occur but only via a tough licensing procedure and high tariffs. So additional direct U.S. actions have little impact and imposing third party or indirect sanctions—sanctioning a foreign entity because it has transactions with North Korea—is difficult since there are often many unintended consequences. Japan and South Korea also now are in similar positions—broad sanctions on top of sanctions are redundant. The EU and Russia this year have further cut their already small amounts of trade with North Korea. This puts all the focus of sanctions on Beijing and it, perhaps not surprisingly, is pushing back, especially on indirect sanctions where the U.S. is seen as intervening in Chinese business.

Details of the Chinese customs data tend to suggest Beijing’s “by the letter” approach to sanctions. Imports of various North Korean precious metal ores are expressly prohibited and these registered zeros in Chinese data for June, July and August, after averaging about 2 or 3 million dollars a month over the past few years. Imports of various rare earths also are prohibited, but these have been negligible to begin with. Meanwhile, China has increased its imports of high valued and unsanctioned zinc, and textile imports have surged following a decline last year. Imports of low-valued and specifically embargoed iron ore also have increased but are still far below levels of a few years ago, and Chinese investment in North Korea’s big Musan iron mine—once promised as a billion-dollar venture on the Chinese border—seems to have stopped. With respect to exports to North Korea, Chinese sales of jet fuel outside of airport activities are prohibited by the sanctions and these, rare anyway, have not occurred since late 2014. Military sales of any kind are prohibited, but Beijing has long denied Pyongyang’s requests for arms. Most controversial, however, are China’s imports of anthracite coal since these are prohibited to the extent that the money goes to the government or the military, and is not used to maintain the miner’s livelihood. But with such purchases accounting for 40 percent of all imports, as reported by its own customs office, it must be impossible for Beijing to know exactly where all of this money is going. Many coal mines in North Korea are run by the military or by political concentration camps and the state tries to control the whole industry through its planning mechanism. Private sales, including exports, are ubiquitous, however, and present a large challenge to the country’s electric power industry which are usually short of coal supplies.

In other trade it is interesting to note that the structure of North Korean imports from China is changing toward higher-end goods as seen in the computer and automobile data. Grain imports are low—and these include overseas aid purchased from Chinese stocks and sent overland to North Korea. Moreover, North Korea’s exports also are changing as textiles and apparel are gaining share and long neglected lead and zinc exports seem to be rebounding. North Korea has some of the largest such non-ferrous metals resources in the world and it has been somewhat of a mystery why it has allowed those industries to founder over the past two decades. Industrial machinery imports still remain low, however, probably reflecting the absence of credit and North Korea’s woefully weak industrial investment.

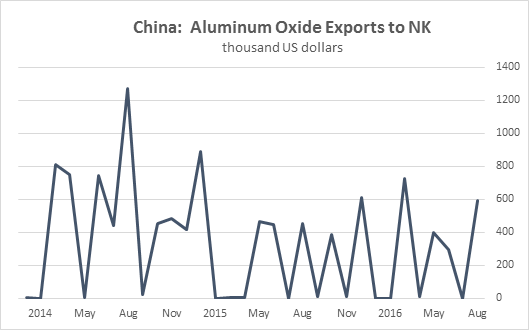

Clearly the U.S. and China need to work together to find a better way to handle the sanctions program if it is to have any chance of success in pressuring the regime and not drive a wedge between the common interests of the U.S. and China. The Chinese may have a point in wanting to encourage what is probably the most market oriented part of the North Korean economy and one would think Chinese traders could develop enough information to ensure the bulk of their trade stays private, given the right legal incentive structure. An encouraging development occurred late last month as U.S. and Chinese officials appear to have cooperated in investigating and sanctioning a Chinese company, Dandong Hongxiang, said by South Korean investigators to be a large commodities trader. Hongxiang was accused of shipping aluminum oxide to North Korea last year among other dual use products. The August Chinese customs data shows a steady flow of aluminum oxide to North Korea over the past years, more than has been attributed to this company, and continuing relatively strongly in August. The material is categorized by nuclear regulators as dual use since in addition to many ordinary uses it is specifically used to prevent rust in centrifuges used for uranium enrichment, and to harden several missile products. North Korea is a significant customer; the U.S., Iran, UAE, and South Korea typically are larger buyers but Pyongyang is regularly among the top five.

Welcome to China: New customs house nearing completion on the China side of Yanji Bridge, North Korea

Welcome to China: New customs house nearing completion on the China side of Yanji Bridge, North Korea

William Brown is an Adjunct Professor at the Georgetown University School of Foreign Service and a Non-Resident Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Main photo from Clay Gilliland’s photostream on flickr Creative Commons. Internal photo from William Brown.